There are so many reasons why a growing manufacturing business would need financing. In today’s modern world, there is a great need for manufacturing industries to modernize their equipment and technology and this requires funding. In addition to this, manufacturing and distribution businesses have to pay their workforce, invest in marketing, and increase production capacity. These are costly expenses that will require financing.

Now if you are acquiring a business, it is important that you get all the information needed before your investment. Price Bailey can help you with how financial due diligence services work and why it is a necessary step. There are various ways these businesses can access financing but not all the available options might be suitable for such a business set up. If your plan is achievable and realistic, it’s important that you back up your options with research. Additionally, you may also opt to speak to a financial advisor in helping prepare for your plan, documents, and feasibility. But truth be told, all businesses must at some point need some working capital to grow and thrive. To help narrow down your search, below are various finance options for growing a manufacturing and distribution company.

1. Manufacturing and Distribution Bank Loans

Today, banks are offering top-rate financing to business owners looking to expand their manufacturing and distribution businesses. The best thing about bank loans is that they are available at affordable rates and have reasonable terms that can range anywhere from a decade or so. But then again, it may be that you’re not looking for a loan that extends for ten years and only requires a loan to invest in your office supplies and stationery. The guys at Elite Tape options advocate for office supplies and stationery saying that for one reason or the other, office supplies and stationery will help to free up your cash flow and improve your company’s workmanship. So whether it’s a stationery loan you want or a loan to increase your inventory, your local bank will have the various options you need to expand your business.

2. SBA Loans for Manufacturing and Distribution Businesses

Depending on the size of your franchise, an SBA loan can be just what you needed to expand your manufacturing and distribution business. However, it may take some time before obtaining this type of financing because today more than ever, banks will require that you provide them with more information. That said, below are tips on how to land an SBA loan for your manufacturing and distribution business:

- Be specific on how much financing you require

- Provide the specifics about your business’s management

- Provide your credit history information

- You may need to offer some form of collateral

- Provide your tax returns

- Provide your financial and bank statements

- You may also be required to show how you’re willing to repay the loan.

3. Investor Loans/ Angel Investment Loans

Today, there are various ways to secure a loan for your business. Investor lending is increasingly gaining popularity in this day and age. These are loans from resourceful investors who’d be willing to partner with you. However, you must be willing to agree to their terms and conditions. In addition to this, you’ll also have to share a commitment contract, agreeing to repay the loan in full and, at the agreed rates.

There are also investors who after lending you an expansion financing, will want to become your business partners. This means that they’ll want to become minority stakeholders in your franchise. Fortunately, these are individuals who are well connected in the market space and have the solutions you need to grow your manufacturing and distribution business. It’s a win-win situation for both of you.

4. Asset Financing

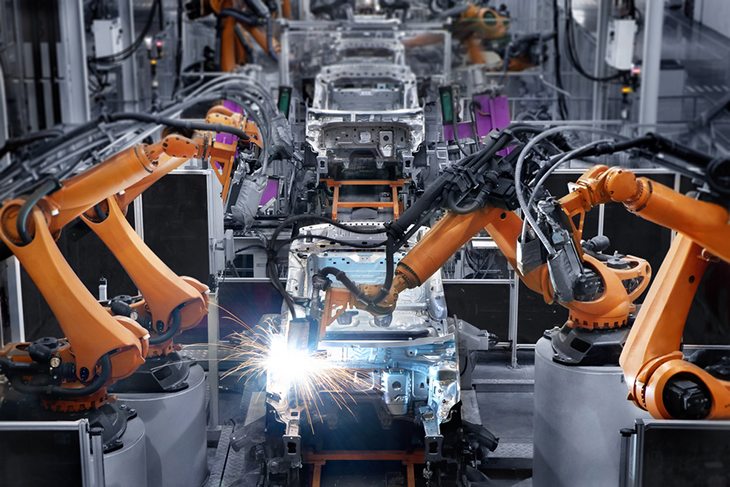

As earlier mentioned, in today’s modern world, there is a need for industries to modernize their infrastructure, equipment, and technology. If you are the owner of a manufacturing and distribution business, you know how crucial fast service and product delivery is to your clients. This is what will keep them coming for more. If you are an established business and can show valuable assets, you can obtain financing through your assets as collateral and raise the funding you need to grow your business without compromising your equity. However, you’ll need to check with your lender to know exactly what they can accept as security.

Today, the manufacturing and distribution industries have become an integral part of service and product delivery. There is, of course, the chain of distribution where retailers will play a key role in linking the distributors with the clients.

As a manufacturer and distribution business owner, you have a huge role to play to ensure continuity in the distribution chain. This means that you’ll require financing for your business to thrive especially when things don’t seem to go your way. The above pointers will provide you with the various financing options but ultimately, it’s for you to decide on the most favorable one.